1. Gold as a store of wealth

2. The Insatiable Demand for Gold

Gold has held a unique position throughout human history, valued not only for its beauty but also for its economic utility. In ancient civilizations such as Egypt, gold was used extensively for ornamental and religious purposes. It eventually became a trusted medium of exchange, with the first gold coins being minted around 600 BC, marking a critical shift toward formalized currency systems.

Its inherent portability, and universal recognition made gold highly desirable in trade and commerce. It, along with silver, played a pivotal role in early financial systems, facilitating large transactions and acting as a dependable store of value.

Gold has long been regarded as a “safe haven” asset. In times of economic turmoil or political uncertainty, its value often increases, offering investors protection. When inflation reduces the purchasing power of fiat currencies, gold typically retains its worth, serving as a financial buffer. Additionally, gold enhances portfolio stability due to its low correlation with traditional assets like stocks and bonds.

In modern financial systems, gold continues to play an essential role. Central banks worldwide maintain substantial reserves of gold, viewing it as a hedge against currency volatility and global financial risk. Investors can now access gold through various means, including physical forms like coins and bullion, or via gold-backed ETFs and tokenization.

Despite the emergence of digital assets and evolving investment tools, gold’s appeal remains strong. Its physical properties—durability, scarcity, and intrinsic value—along with its historical role in global finance, contribute to its continued relevance. For both individual investors and institutions, gold remains a reliable component for wealth preservation and risk management.

The Insatiable Demand for Gold

Gold’s universal appeal continues to drive strong global demand, rooted in its reputation as a safe-haven asset and its diverse applications. In times of economic uncertainty, inflation, or market volatility, investors turn to gold to preserve wealth, making it a cornerstone of financial security.

Central banks worldwide are steadily increasing their gold reserves to diversify away from traditional currencies. Meanwhile, cultural traditions—especially in countries like India and China—fuel consistent consumer demand, as gold remains central to weddings, festivals, and religious ceremonies.

Beyond investment and cultural use, gold’s unique physical properties make it essential in industries such as electronics, dentistry, and aerospace. This industrial demand further supports its value.

The rise of digital gold platforms has made owning gold easier and more accessible, expanding its investor base. In a rapidly changing global landscape, gold’s timeless allure and proven resilience continue to sustain its insatiable global demand.

- Gold demand hits new record in 2024

- Central banks continued to hoover up gold at an eye-watering pace

- Annual investment reached a four-year high of 1,186t (+25%).

- Gold ETFs and investors had a sizable impact

- Full-year bar and coin demand remains strong.

- Technology demand grew by 21t (+7%), largely driven by growth in AI adoption.

- Gold jewellery spend jumped 9% to US$144bn.

1. Why Gold Remains the Ultimate Safe-Haven Asset

2. How Does Quantitative Easing Impact Gold?

In times of financial, economic uncertainty and market volatility, investors have historically turned to gold as a dependable safe-haven asset. Its reputation as a symbol of stability, resilience, and intrinsic value has made it a consistent choice for protecting wealth during turbulent times.

- Economic Stability: Gold is a long-standing symbol of financial security. Unlike paper currencies, which can lose value during economic downturns, gold retains its intrinsic worth. During past crises, such as the 2008 recession, gold’s value surged while stock markets collapsed, reaffirming its role as a reliable store of value. Investors turned to gold for its proven ability to preserve value and act as a safeguard during unpredictable financial periods. Whether driven by market downturns or geopolitical instability, gold’s consistent performance continues to inspire investor trust.

- Inflation Protection: Gold acts as a hedge against inflation preserving the real value of wealth. Unlike paper money that can be devalued by excessive printing, gold maintains its purchasing power, and as living costs rise, gold often becomes more attractive, offering protection against the eroding effects of inflation.

- Diversification: Essential for minimizing risk, gold plays a unique role due to its low correlation with traditional asset classes like stocks and bonds. During market volatility, gold often behaves inversely, rising when other assets fall. Gold’s ability to offset losses in other investments makes it a strategic addition for investors seeking to create a well-rounded and resilient portfolio.

- Crisis Resilience: Throughout history, gold has shown strength during geopolitical tensions and financial turmoil. During events like the COVID-19 pandemic, gold prices surged while markets tumbled, demonstrating its value as a refuge. Gold’s performance during periods of crisis highlights its status as a robust asset. This pattern has been repeated across history; in times of war, political instability, or market crashes, gold has preserved wealth and provided financial security. Its resilience is not new—it has endured for centuries as a protective asset amid global uncertainty.

- Global Demand: Gold’s appeal is strengthened by its global demand, both as an investment and for industrial uses such as electronics and dentistry. Investment demand remains strong, supported by innovations like digital gold offerings, which enhance accessibility. Additionally, gold’s liquidity makes it easy to convert to cash when needed.

Conclusion: In a constantly shifting financial landscape, Gold’s enduring value, stability, intrinsic worth, resilience, and global recognition make it a preferred asset for protecting and preserving wealth amid financial instability.

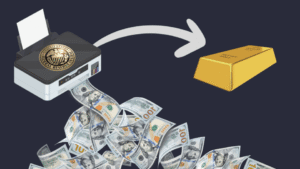

How Does Quantitative Easing Impact Gold?

The long-term risks of quantitative easing, including eroding the credibility of the US dollar, are closely linked to gold’s performance and tend to increase gold’s appeal as a safe, tangible asset.

What is Quantitative Easing?

Quantitative easing (QE) is a strategy designed to stimulate the economy when all other options (such as lowering interest rates) have been exhausted.

Step 1: The Fed purchases government bonds. To do this, the Fed creates reserves out of thin air.

Step 2: Banks use these new reserves to give out loans. The effect is two-fold: increasing the money supply and suppressing interest rates. (however, the banks use QE as a way of increasing their cash reserves, undermining the benefits of QE)

How Quantitative Easing (QE) Impacts Gold

While QE doesn’t have a short-term statistical impact on gold prices, its long-term effects tend to push gold prices higher due to several key factors:

- Rising Inflation: QE increases the money supply, devaluing each dollar and eventually leading to higher prices for goods and services, which drives up gold prices.

- Asset Bubbles: New money often flows into unproductive assets, fuelling inequality and market volatility. When these bubbles burst, investors turn to gold as a safe haven.

- Debt Crises: QE-driven credit expansion shifts purchasing power from the future to the present, creating unsustainable debt levels. When lending stops and defaults rise, gold retains its value because it carries no counterparty risk.

- Federal Reserve Credibility: Since fiat currencies rely on trust rather than gold backing, excessive QE can undermine confidence in the central bank’s ability to manage the economy, making gold more appealing as a stable store of value.